Trading Signals 05/02 – 09/02

Will the Price of Gold Rise by the End of the Year?

As global markets continue to experience uncertainty and fluctuations, many investors turn to gold as a safe haven asset. Gold has historically been a reliable store of value and a hedge against inflation.

Market Dynamics and Macroeconomic Factors

Recently, gold prices have been rising as markets focus on Federal Reserve rate cut bets and regional bank woes. The precious metal has been holding steady above $2,020, despite modest US dollar strength capping gains. The ongoing inflationary pressures in the US and around the world have been contributing to the increasing demand for gold as a hedge against inflation.

Inflationary pressures are of particular interest, as they often prompt investors to seek refuge in gold as a hedge against currency devaluation. Given the current global economic climate, characterized by rising inflation rates and supply chain disruptions, it is plausible that gold prices may continue their upward trajectory by year-end.

Monetary policy

Central banks around the world have been adopting accommodative monetary policies to support their economies during the pandemic. This has led to low or negative interest rates, which can be supportive of gold prices. If central banks maintain these policies, gold prices may continue to rise.

The forthcoming decision on interest rate adjustments by the Federal Reserve could trigger fluctuations in the market, impacting the American currency, stocks, and resources. A less aggressive Fed outlook favors XAU/USD, restraining the growth in bond yields and the USD, which in turn benefits non-interest-bearing gold. Recently, the central bank has embraced a more rigorous method towards interest rate hikes, contemplating a temporary halt in its cycle. Financial markets foresee potential rate reductions; however, encouraging employment figures imply a continuous assertive position. The Fed has raised interest rates for the tenth occasion but might suspend further increases in June. Labor statistics could sway expectations for rate reductions or the maintenance of elevated rates, as April’s data reveals persistence in job and salary expansion, alleviating recession apprehensions.

Demand and Supply Factors

Another crucial aspect to consider is the balance between gold demand and supply. A surge in demand, driven by factors such as increased central bank purchases, robust investment demand, and strong consumer demand for jewelry, can contribute to a rise in gold prices.

In 2022, the annual gold demand (excluding OTC) increased by 18% YoY to reach 4,741t, which is the highest yearly total since 2011. This growth was driven by central bank purchases, which more than doubled to reach a 55-year record high of 1,136t, and consistently strong retail investment. During Q4 2022 alone, central banks purchased 417t of gold. Investment demand (excluding OTC) increased by 10% YoY, mainly due to a slowdown in ETF outflows and strong gold bar and coin demand. However, jewelry demand decreased slightly by 3% YoY, primarily due to a 15% drop in Chinese annual jewelry demand resulting from COVID-19 lockdowns throughout the year. The total annual supply increased modestly by 2% YoY to 4,755t, with mine production reaching a four-year high of 3,612t.

Geopolitical risks

Geopolitical tensions can also impact gold prices, as investors seek safe-haven assets during times of uncertainty. The ongoing conflict in Ukraine and tensions between the US and China are examples of geopolitical risks that could support gold prices in the long-term.

Technical Analysis

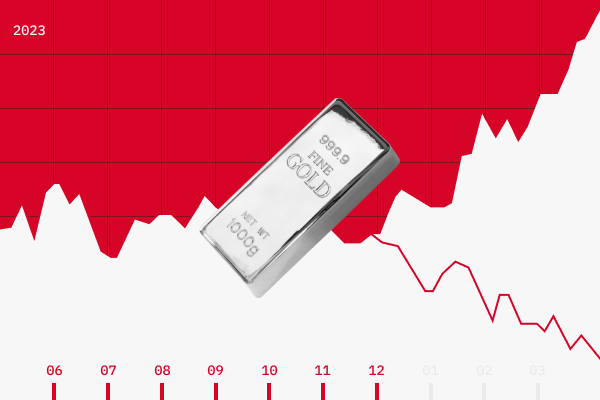

Gold prices reached a new all-time record high of $2,079 in the spot market following a recent Federal Reserve meeting and a 0,25 point interest rate hike.

*Spot Gold Monthly Chart

As of now, the current spot price of gold has been consolidating strongly above the psychological level of $2000 and has broken out above the horizontal resistance zone of $2020, creating a base for spot prices to reach new all-time highs of $2079 and beyond.

However, there are some potential risks on the horizon, such as the looming issues of a debt ceiling deadlock and a banking credit crisis, as well as predictions of a pause in Fed rate hikes in June. These factors could trigger an increase in the spot price of gold to $2100 initially and possibly even $2150.

Additionally, there could be a short-term correction towards the support levels of $2020-$2010, which could provide a buying opportunity for investors who missed out on the earlier rise. Nevertheless, the upward trend for gold is expected to continue as long as the daily close remains above $2000, which could become the new normal for gold prices should the support levels hold.

Wrap Up

Given the range of factors affecting gold prices and the variety of predictions from different analysts, such as $3,723 by mid-2027 or $5,491 by 2030, it is challenging to predict with certainty whether gold prices will rise by the end of the year. However, as a long-term investment, gold has historically proven to be a reliable store of value and hedge against inflation. Investors should keep a close eye on global market developments and adjust their gold holdings accordingly.

Oil: A Review of Early 2024

China’s Economy: Early 2024

Simple Strategy for Beginner Traders