Trading Signals 05/02 – 09/02

Top 5 Stocks to Pay Attention in January

As we step into the new year, the global stock market presents a dynamic landscape, ripe with opportunities and challenges. We spotlighting key players that have shown resilience, strategic growth, and potential in the face of economic fluctuations. From healthcare giants to rail industry leaders, these companies have navigated market complexities with innovative strategies, robust financial performance, and a keen eye on future expansion.

UnitedHealth (UNH)

UnitedHealth Group (UNH), a powerhouse in healthcare and insurance, is recognized for its solid mix of growth, stability, and dividends, boasting a hefty market cap of about $500 billion. The company has impressively doubled in size within five years, with annual revenues topping $300 billion and consistent profitability. Its aggressive growth strategy includes major acquisitions like Amedisys and LHC Group, enhancing its market presence.

Despite a modest dividend yield, UnitedHealth’s record of steady dividend growth is appealing to investors. After a period of market downturn, the stock has rebounded to around $520, a level that has been challenging to surpass in the past. However, with the company’s strong performance and positive market trends, analysts anticipate a potential rise to the $600 zone. UnitedHealth stands out as a reliable healthcare stock, offering investors a stable and promising addition to their portfolios.

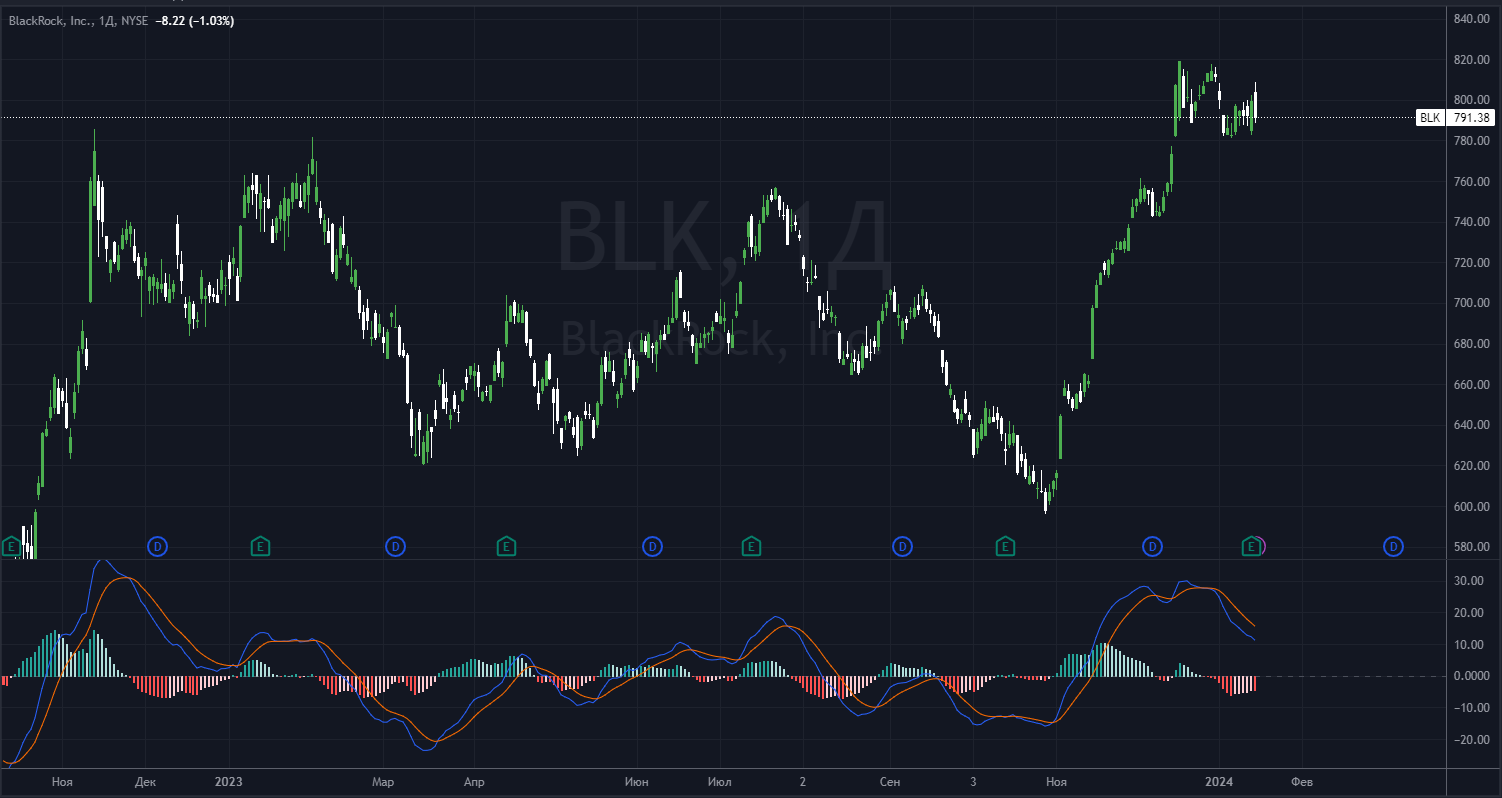

BlackRock (BLK)

BlackRock (BLK), with assets of $9.1 trillion, has demonstrated resilience and growth in a challenging economic climate. In Q3 2023, the company reported a 5% revenue increase, bolstered by organic growth and a significant rise in Assets Under Management (AUM) by $1.1 trillion, leading to a 7% increase in operating income. The company’s strategic focus on client-centric solutions and its strong performance in private markets and ETFs underscore its position as a market leader. Despite a recent stock price surge

and a valuation above the five-year average, BlackRock maintains a solid dividend yield of 2.64% and has shown commendable dividend growth. After a downward trend for most of 2023, the stock price rebounded from $600 to around $800 in the last two months. While some caution is expected in the near term, BlackRock’s focus on ETFs and private markets, coupled with its financial stability, positions it well for sustained growth in the face of economic uncertainties.

General Electric (GE)

Under CEO Larry Culp, General Electric (GE) has impressively transformed, with its stock soaring 166% in five years. Strategic moves, especially in portfolio restructuring, have propelled GE’s success despite market challenges. The aerospace sector, a standout under Culp, saw a 34% order increase in Q3, pushing total orders to nearly $18 billion. Financially, GE’s Q3 was strong with a notable 18% revenue increase to $16.5 billion and adjusted EPS of $0.82, surpassing expectations.

However, GE’s renewable energy sector faces profitability challenges, notably in offshore wind, alongside a significant $6 billion debt. The stock has been on an upward trend, rising from $47 to $130 in 18 months, and analysts predict further growth. GE’s robust performance, particularly in aerospace, coupled with strategic initiatives, positions it as an appealing investment, though it must navigate challenges in its renewable energy division to secure long-term profitability.

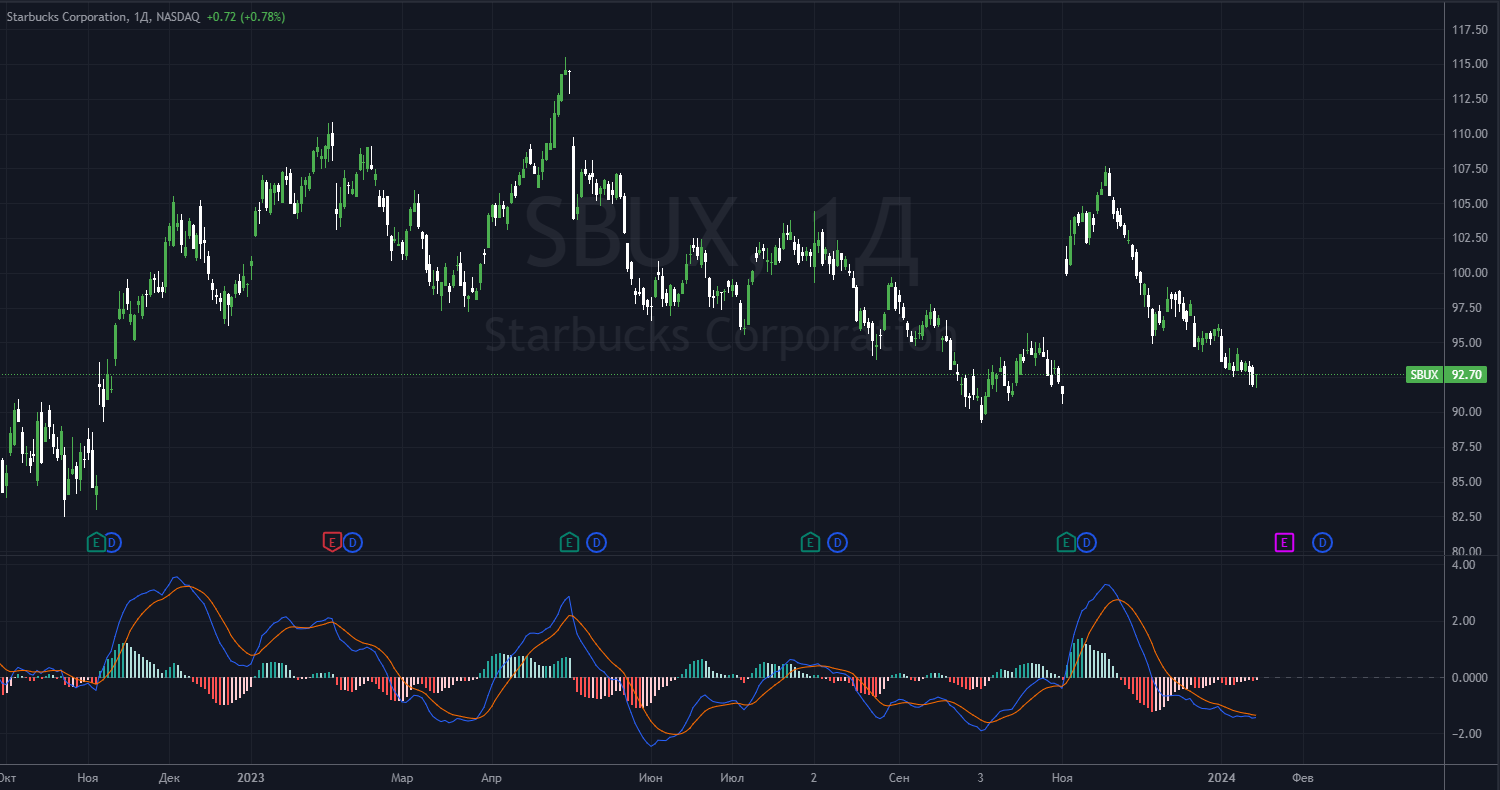

Starbucks (SBUX)

Starbucks showcases strong growth, with a global presence of around 38,000 stores and a strategic plan to hit 9,000 stores by 2025. The company’s commitment to digital expansion and the Starbucks Rewards program has been fruitful, with nearly 33 million active members. Financially, Starbucks reported a significant revenue increase to $35.976 billion in FY

2023, with a notable rise in both company-operated and licensed store incomes. Despite some market concerns and a recent stagnation in stock price within the $90-$100 range, Starbucks’s consistent performance and strategic initiatives, particularly in digital engagement and market expansion, position it well for future growth. Analysts anticipate a potential uptick in stock value, projecting a move towards the $115-$120 range in early 2024, reflecting confidence in Starbucks’s ability to navigate market challenges and capitalize on its strong brand and operational efficiency.

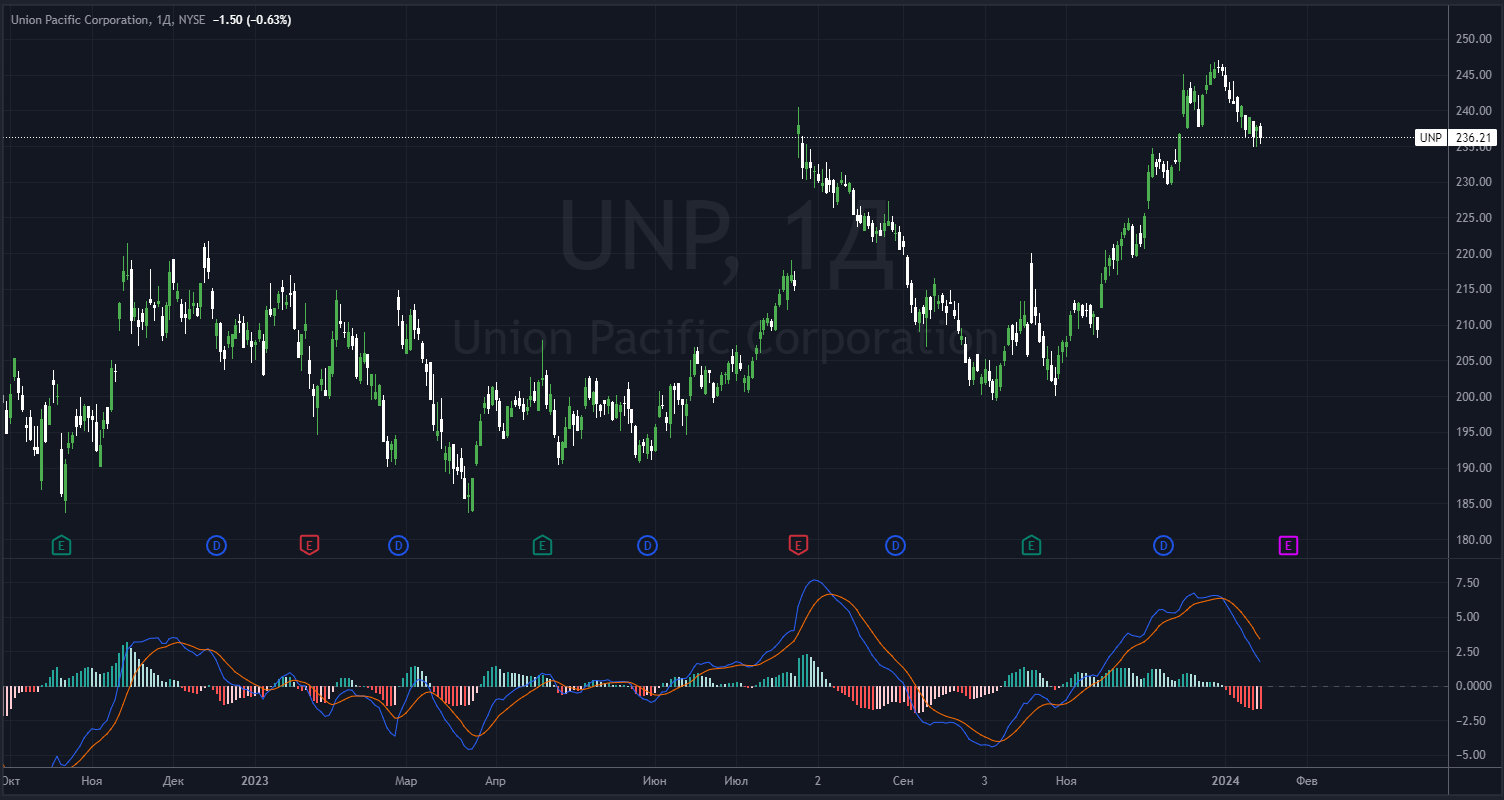

Union Pacific (UNP)

Union Pacific (UNP), a key player in the U.S. rail industry, has a vast network connecting to Canada and Mexico, with significant assets and a focus on the western U.S. Despite challenges in volume dynamics, the company has boosted revenues through strategic price increases and cost management. Its productivity has improved even with a leaner workforce, reflecting its operational efficiency.

The company’s strategic initiatives, like the Falcon Premium Service in collaboration with Grupo Mexico and Canadian National, aim to enhance its competitive edge. Despite economic headwinds, Union Pacific’s commitment to efficiency and shareholder value is evident. Its expansion into services like the Eagle Premium Service with Ferromex connects U.S. markets with Mexico, capitalizing on economic opportunities.

However, Union Pacific’s substantial net debt of $32 billion and interest expenses pose challenges, especially with current refinancing rates. The stock showed stability in early 2023 but recently saw an uptick to around $250. While analysts suggest cautious growth expectations, Union Pacific’s strategic focus, efficiency, and expansion plans make it a noteworthy player in the rail industry with potential long-term investment appeal.

Oil: A Review of Early 2024

China’s Economy: Early 2024

Simple Strategy for Beginner Traders