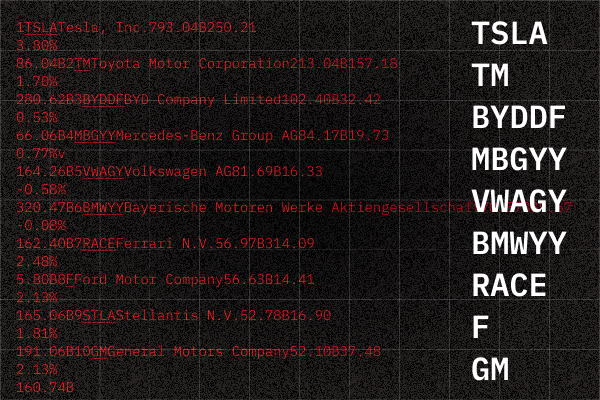

Trading Signals 05/02 – 09/02

Investment Green Light: Auto Stocks

Investing in auto stocks has consistently been a popular choice among investors, and the reasons are clear. Automobiles are not just a cherished asset for many, they are also an essential part of daily life. It’s no wonder that the worldwide auto market is valued in the trillions and is on an upward trajectory. Although Asia commands a substantial portion of the auto market, auto manufacturers from America and Europe are hot on their heels. These firms, which sprouted in places like Detroit, London, and Maranello, could never have envisioned they would evolve into some of the biggest auto producers in the US and Europe, churning out some of the most iconic cars globally.

These auto giants from the US and Europe hardly require an introduction – their market capitalization exceeding 1 billion dollars eloquently testifies to their prominence. However, an important caveat to remember is that the superior performance of these cars on the streets doesn’t guarantee that their stocks will steer your portfolio towards gains. Hence, comprehensive analysis is always a prerequisite before making investment decisions.

Tesla (TSLA):

The journey of Tesla mirrors the twists and turns of a Hollywood thriller – teetering on the brink of bankruptcy, then rising to become the most traded stock, weathering numerous storms, and ultimately ascending to become the first-ever car manufacturer with a market value of $1 trillion – quite a thrilling narrative, isn’t it? For a long period, Tesla grappled with profitability issues, with its earnings primarily stemming from credit sales. However, in 2021, Elon Musk, the company’s CEO, managed to overcome significant supply chain challenges, doubling the production volume to 963,172 electric vehicles and securing annual profits of $5.5 billion. Tesla, for a time, was a notable Bitcoin holder, but it decided to step back from this venture (at least temporarily) due to environmental concerns.

Ford Motor:

When automotive behemoths like Ford begin to phase out the production of gasoline-powered cars in favor of their electric variants, it’s a clear signal that the auto industry is firmly steering towards electric vehicles. This shift also indicates that the American market is recalibrating its strategies with an aim to emerge as a leader in electric vehicle production. Ford’s stock has been on a steady upward trajectory since 2020, and in 2022, it reached a decade-high. The company’s market capitalization now stands at approximately $80 billion, with revenues soaring to $153 billion. Ford’s leadership has earmarked a $30 billion investment in electric vehicles by 2025, and by 2030, they anticipate that 40% of Ford’s sales will be electric cars. Currently, Ford’s shares are trading around $20.

General Motors:

General Motors, a global titan in the automobile manufacturing industry, boasts a market capitalization of approximately $90 billion. The company’s stock has been on a consistent upward trend since 2020, and in 2022, it hit a 10-year peak. The company’s revenues have surged to $145 billion. The leadership at General Motors has outlined ambitious plans to cease the sale of gasoline and diesel cars by 2035. They have also committed to investing $27 billion in the development of electric and autonomous vehicles by 2025.

Honda Motor Co Ltd:

Honda, hailing from Japan and a key player in the global automobile industry, has a market capitalization around the $50 billion mark. The company’s stock has been on a steady incline since 2020, and in 2022, it reached a decade-high. The company’s revenues have swelled to $140 billion. Honda’s leadership has set forth a strategic plan to ensure that by 2030, at least two-thirds of its sales will be from electric or hybrid vehicles.

Mercedes-Benz Group AG:

Mercedes Benz is renowned for its wide-ranging portfolio, spanning from budget-friendly hatchbacks to opulent electric sedans. However, in 2022, the car manufacturer made a strategic decision to discontinue several of its most affordable Internal Combustion Engine (ICE) models to solidify its standing in the premium segment. According to the company’s CEO, Ola Källenius, this move towards becoming an exclusively luxury brand will aid the iconic German car manufacturer in boosting its profitability ratio to between 13% and 15% by 2050. These changes elicited a muted response from investors, as Mercedes’ shares experienced some turbulence in the first half of 2022. Despite this, the company managed to double its revenues last year compared to the pre-pandemic period, reaching 14 billion euros, and its valuation approached 70 billion euros.

Ferrari:

Ferrari, a name synonymous with luxury and performance, is a brand that stands on its own. This Italian car manufacturer, celebrated for its high-end sports cars, boasts a market capitalization of approximately $40 billion. Ferrari’s stock has been on a consistent upward trajectory since 2016, and in 2022, it hit a decade-high. The company’s revenues have surged to $4.5 billion. The leadership at Ferrari has set forth an ambitious plan to launch the brand’s first fully electric vehicle by 2025.

Volvo:

Volvo, a Swedish car manufacturer, has a capitalization of about $20 billion. The company’s shares have been growing steadily since 2020, and in 2022 they reached their highest level in the last 10 years. The company’s revenues have grown to $30 billion. The company’s management plans to become a fully electric car company by 2030.

Wrap Up

In the fast-paced world of auto stocks, change is the only constant. As we’ve seen, industry giants like Tesla, Ford, and General Motors are not just surviving but thriving amidst these changes. They’re leading the charge towards a more sustainable future, with electric vehicles at the forefront of their strategies.

Honda and Mercedes-Benz, too, are making significant strides in this direction, proving that the shift towards electric and hybrid vehicles is a global movement. Even luxury sports car manufacturer Ferrari is joining the race, with plans to launch its first fully electric vehicle.

However, as with any investment, it’s crucial to remember that past performance is not indicative of future results. While the auto industry’s future looks promising, it’s essential to conduct thorough research and consider various factors before making investment decisions.

The world of auto stocks is dynamic and exciting, offering a unique blend of tradition and innovation. As these companies continue to evolve and adapt to the changing landscape, they offer intriguing opportunities for investors willing to navigate the twists and turns of this thrilling sector.

Disclaimer: The information provided should not be interpreted as investment advice and should not be relied upon for making investment decisions. All material(s) have been sourced from what are believed to be reliable sources, but the accuracy of the information at the time of receipt cannot be guaranteed. There is no assurance or warranty regarding the current accuracy of, nor responsibility for, decisions made based on such information.

Fluctuations in exchange rates may negatively impact the value, price, or income of an investment. Past performance does not guarantee future results, and the value of such investments and their strategies may decrease as well as increase.

Oil: A Review of Early 2024

China’s Economy: Early 2024

Simple Strategy for Beginner Traders