Trading Signals 05/02 – 09/02

Gold at its Peak: To Buy or Sell?

Gold rises amid weakening dollar and ongoing geopolitical risk. The gold market has once again caught the attention of bulls, as prices kicked off the trading week at a six-month high, surpassing $2000 per ounce. The precious metal’s quotes have recovered from the decline seen in the first half of the month and continue their ascent.

By Wednesday, November 29, the upward momentum had driven gold to $2050. This level is a key resistance zone, clearly visible to all. Since 2020, it has thrice acted as a turning point for rising trends. The visibility of this moment makes these thresholds particularly significant. Should the $2050 resistance be breached, the rally could gain momentum, potentially reaching $2070, and the medium-term sentiment in the precious metals market would improve.

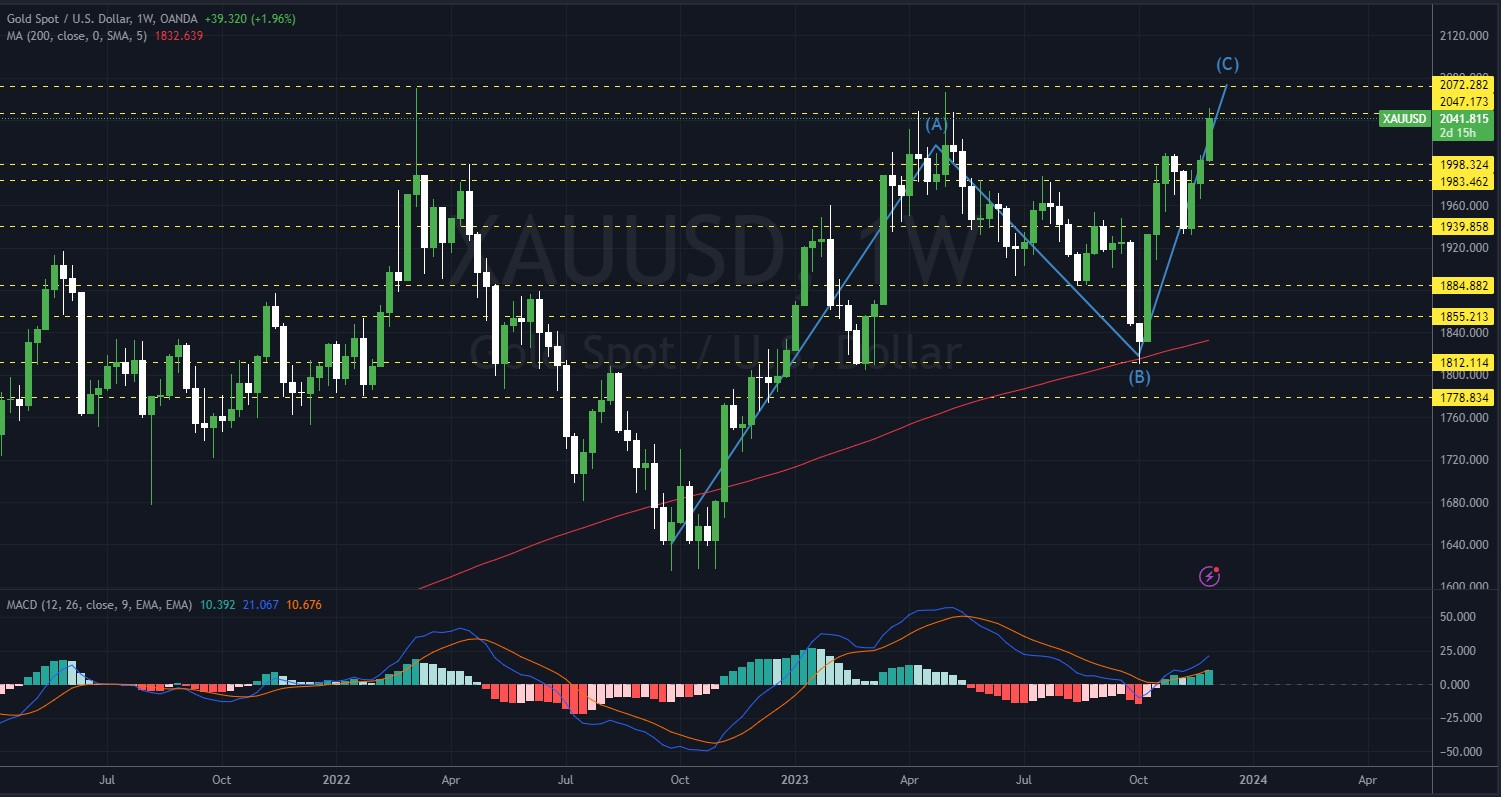

Weekly Chart

On the weekly chart, it’s evident that the next target is at the $2070 level, according to the Elliott Correction Wave (ABC) model. The MACD also indicates a likely continuation of growth in the medium-term perspective.

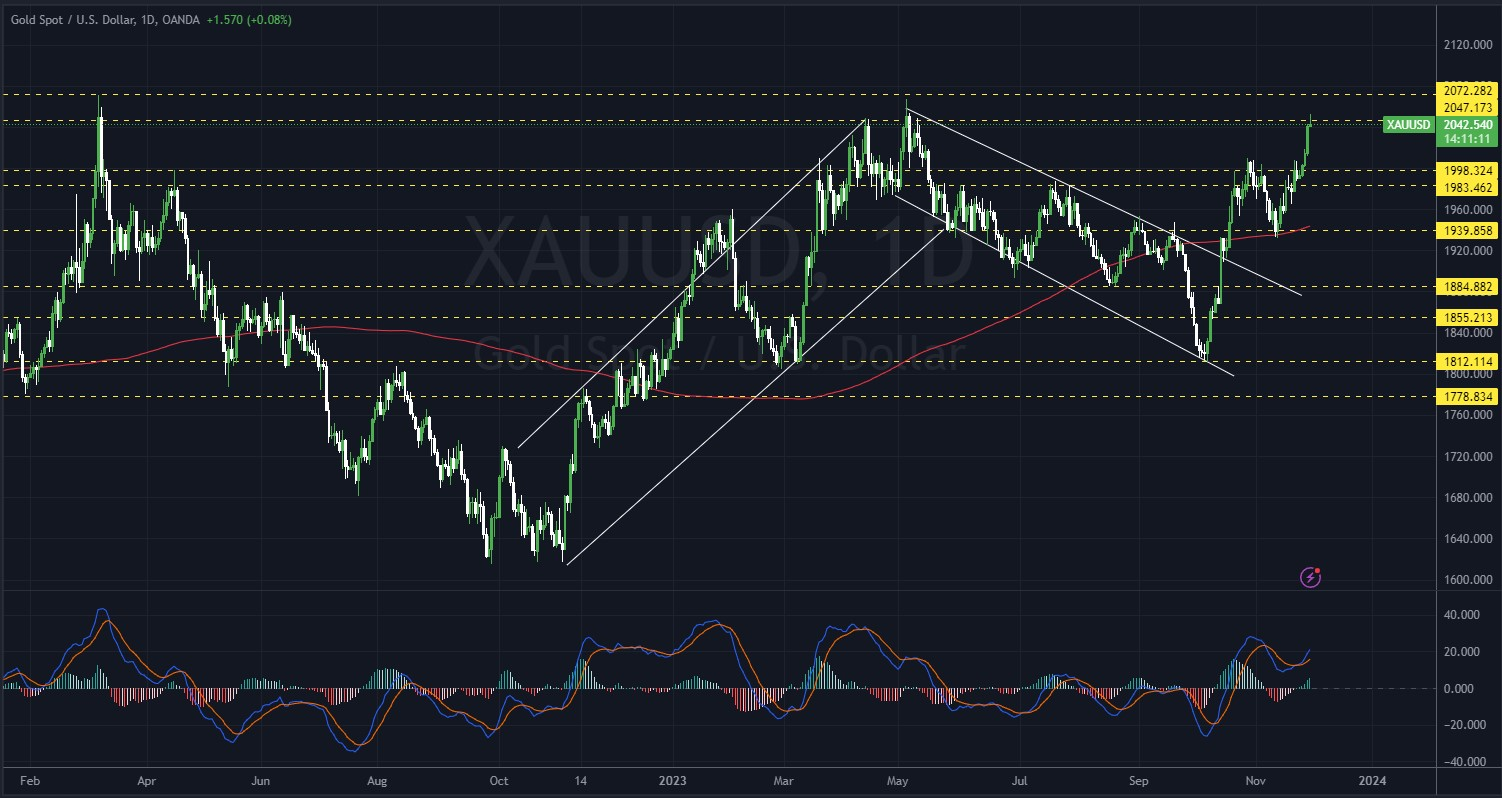

Daily Chart

On the daily chart, the implementation of the Ascending Flag pattern clearly indicated a continuation of the upward trend. The price is challenging the $2050 resistance level. As previously mentioned, this is a strong historical resistance level and, from a technical standpoint, bears might halt the rise. Additionally, it should be considered that profit-taking might occur at this level, which could also lead to a corrective decline in gold prices.

4 Hour Chart

On the 4-hour chart, a reversal pattern can be observed from the perspective of candlestick analysis. The Hanging Man pattern suggests a potential correction towards the $2017 support level. There is also an ascending trend line that could act as a support level.

What the Analysts Say

Goldman Sachs has recently raised its 12-month forecast for gold to $2,050, highlighting a range of factors that could drive prices up. This includes the interplay of US real interest rates and dollar value fluctuations, alongside strong consumer demand from major markets like China and India. They also anticipate significant buying from central banks.

The broader economic outlook, as per various market analysts, suggests that the Federal Reserve might hold off on interest rate cuts until late next year. This perspective, aligning with Goldman Sachs’ view, lends support to gold prices in the current economic scenario.

Looking at the commodities market as a whole for 2024, there’s a general consensus among analysts for a positive yield, particularly in sectors like energy and industrial metals. This optimistic forecast is part of a larger trend, where commodities are seen as a strategic hedge against potential supply disruptions.

In essence, the market analysis for 2024 indicates a strong position for gold, not just due to economic factors but also as a traditionally stable investment in times of uncertainty. The consensus among analysts is that gold will continue to be a sought-after asset, especially as a safe-haven in the coming year.

Oil: A Review of Early 2024

China’s Economy: Early 2024

Simple Strategy for Beginner Traders