Trading Signals 05/02 – 09/02

Best Trading Strategies in 2024

Trading on stock or cryptocurrency exchanges without a well-thought-out plan is akin to gambling, not trading. While it’s possible to win, only a few get lucky. It’s far more logical to use pre-planned strategies.

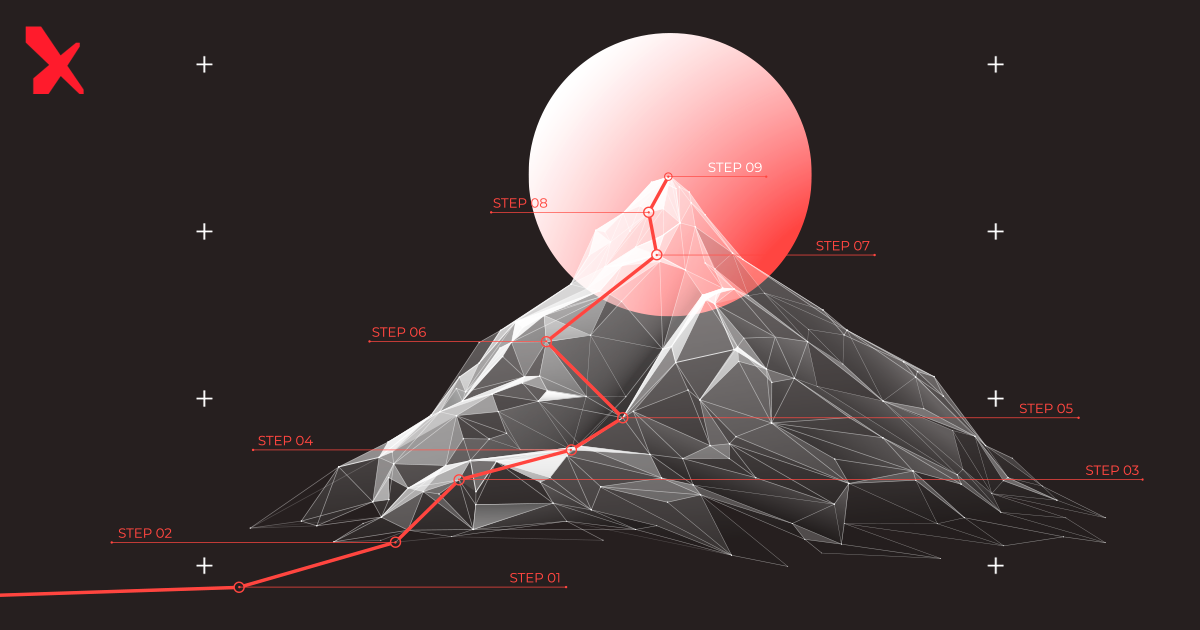

Every beginner delving into trading soon realizes a stark truth – every amateur mistake costs them out of their own pocket. Avoiding missteps is possible by following a strategy. This requires methodically determining entry and exit points in the market. Among such methods, there are both proprietary know-hows and well-known strategies. Here are the top 10 trading strategies for 2024.

What Is a Trading Strategy?

More accurately called a “trading strategy,” it’s essentially a set of rules formed into an algorithm. It takes into account risk management, entry and exit rules, position holding, market situation, and other nuances. Strategies are used to optimize market information analysis and, accordingly, select a unique trading decision.

Trading strategies in the stock and cryptocurrency markets may have similarities, but there are also significant differences.

- The cryptocurrency market is more volatile compared to the traditional stock market. Token prices can fluctuate greatly in the short term. Cryptocurrency offers more opportunities for short-term trading, but the risks are exponentially higher.

- Regulation. Stock markets are generally regulated by government bodies and comply with legislative requirements. Cryptocurrency is less regulated, but this process is in an active stage of development. It’s important to note that insufficient regulation affects market volatility and stability. For a trader, this is neither good nor bad – it’s simply a fact to consider.

- Operating Mode. The cryptocurrency market is open for trading 24/7, while traditional exchanges operate during specific hours. Both markets respond vividly to global events, but they may not do so simultaneously due to time zone differences and exchange operating hours.

- Information Accessibility. Information about securities traded on stock exchanges and companies’ financial indicators is publicly available. Data on cryptocurrencies may be more limited and less transparent. Considering that new projects emerge frequently, this situation only becomes more complex.

Top 5 Profitable Trading Strategies

Before delving into strategies, remember that their effectiveness in the stock market can change over time. Past results are not a guarantee of future profitability.

- Trend Following

This strategy is based on the idea that stocks showing a steady trend in one direction (up or down) may continue to move in that direction. Traders try to capture the trend by opening positions in the direction of the price movement.

- Overbought / Oversold

Based on the assumption that stocks that have significantly risen (overbought) or fallen (oversold) may undergo a price correction. Traders use various technical indicators to determine this, with the Relative Strength Index (RSI) being a primary one. Overbought stocks are identified with an RSI of 80 and above, while oversold stocks are at or below an RSI of 30.

- Moving Average Crossover

This strategy is based on the crossing of two moving averages of different periods. Moving averages are curve lines on a chart showing the average value for a selected period. For example, to calculate a 10-day moving average, take the sum of prices for 10 days and divide it by 10.

The essence of the moving average crossover strategy is as follows: when a short-term moving average (say, 50-day) crosses a long-term moving average (say, 200-day) from below upwards, it can be considered a buying signal. This method is used to determine a change in trend direction. Moving averages can be for 10, 20, 50, 100, and 200 days.

- News-based Trading

One of the oldest strategies – using news and events that can affect stock prices. Traders look for news about companies, industries, or the economy to make decisions about buying or selling stocks. Market reactions to events can create opportunities for profitable trading.

For example, a company in a pre-bankruptcy state, but not yet bankrupt, is already laying off employees and disposing of assets. Consequently, such a company’s stocks will go down.

- Pair Trading

Simultaneous buying and selling of two related financial instruments, usually stocks or other related assets. The goal of the strategy is to profit from the relative strength or weakness between these instruments. A popular example is the prices of oil and the stocks of oil companies.

How to Choose a Trading Strategy?

There are several fundamental factors to consider that affect the success and suitability of your chosen trading strategy to your goals.

Trading Goal

Determine what you aim to achieve with trading. Some traders might be interested in short-term profits, while others aim for long-term investment. Your strategy should align with these goals. For instance, if your objective is scalping (making a large number of trades within a day) for quick profits, a short-term trading strategy would be preferable.

Risk Tolerance

Evaluate the risks associated with the strategy. Scalping, for example, requires more active risk management due to its association with high-volatility assets. On the other hand, trend trading is more long-term and considered less risky.

Analytical Skills and Experience

Some strategies require technical analysis, understanding of charts, indicators, and patterns. Others might be based on fundamental analysis, which involves studying economic and financial data. Don’t overestimate your knowledge and choose a strategy that you can effectively apply and develop at your level.

Market Conditions

Market conditions can also impact the effectiveness of a strategy. Certain algorithms are suitable for specific types of markets, such as trending or sideways markets. Study the current market conditions and consider them when choosing a strategy.

Oil: A Review of Early 2024

China’s Economy: Early 2024

Simple Strategy for Beginner Traders